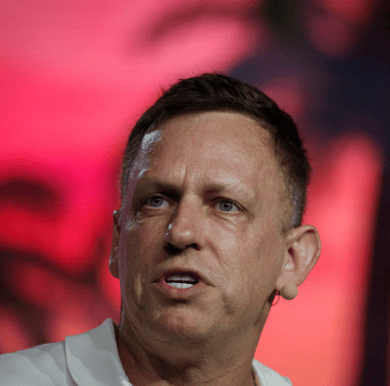

Silicon Valley billionaire and venture capitalist Peter Thiel has made his largest political donation in years—writing a $3 million check to help stop California’s proposed Billionaire Wealth Tax. The contribution marks an early and powerful strike in what is shaping up to be one of the most expensive and controversial ballot battles of 2026.

The Palantir co-founder’s donation was made on December 29 to the California Business Roundtable, a Sacramento-based lobbying organization that represents major employers and corporate leaders across the state. Public disclosures show this is the first seven-figure contribution tied directly to the campaign opposing the 2026 Billionaire Tax Act—and Thiel’s biggest political gift since the 2022 midterm elections, when he spent over $35 million backing conservative candidates nationwide.

Why Peter Thiel Is Taking a Stand

Peter Thiel is no stranger to political influence. As one of the most prominent tech investors in the world, his financial backing often signals serious momentum. His latest move positions him as a central figure in the effort to block what many business leaders see as a punitive wealth tax on billionaires in California.

While the donation isn’t officially earmarked for the wealth tax fight, the California Business Roundtable is expected to lead the opposition campaign. Its president, Rob Lapsley, has confirmed that the organization is actively recruiting high-net-worth donors to fund a coordinated resistance strategy.

This early investment suggests that Thiel—and others in California’s elite circles—are preparing for a long, expensive political battle.

What Is California’s Billionaire Wealth Tax?

The 2026 Billionaire Tax Act proposes a one-time 5% tax on the net worth of California residents with more than $1 billion in assets. Unlike traditional income taxes, this measure targets total wealth, including:

Privately held businesses

Stocks and bonds

Art and collectibles

Intellectual property

Other high-value assets

Certain categories—such as real estate, pensions, and retirement accounts—would be excluded. Still, the tax would capture a large portion of ultra-wealthy portfolios.

If approved by voters, the tax would apply to residents as of January 1, 2026, with asset values calculated at the end of the year. Payments would begin in 2027, and billionaires could spread the cost over five years—though doing so would add a 7.5% annual nondeductible charge, significantly increasing the total amount owed.

A Growing Fear of Wealth Flight

Critics argue the tax could trigger a mass exodus of billionaires from California, weakening the state’s economy and innovation sector. Several high-profile founders and investors have already relocated to states like Texas and Florida, citing high taxes and regulatory pressure.

Thiel himself owns property in Miami but remains deeply connected to Silicon Valley through his investments. Instead of quietly distancing himself, he’s chosen to engage directly in the political process.

Other wealthy figures, including Chamath Palihapitiya and Bill Ackman, have publicly opposed the tax, warning that it could discourage entrepreneurship and reduce California’s appeal as a global tech hub.

An Unlikely Ally: Governor Gavin Newsom

In a rare political crossover, Governor Gavin Newsom has also spoken out against the billionaire wealth tax. He has called it “bad policy,” arguing that even proposing such a measure damages California’s reputation with investors and business leaders.

Newsom’s stance puts him at odds with progressive activists who view the tax as a way to fund public services and reduce inequality. Still, his opposition gives the anti-tax movement added credibility across party lines.

The Battle for the Ballot

Supporters of the tax must gather nearly 900,000 valid signatures to place the measure on the November 2026 ballot. That process alone will take months and millions of dollars.

Opponents predict total campaign spending could exceed $75 million, making it one of the most expensive ballot fights in California history. Thiel’s $3 million contribution is widely seen as the opening shot in a much larger fundraising effort.

With business groups, billionaires, labor unions, and political leaders all weighing in, the wealth tax debate is quickly becoming a defining issue of the election cycle.

Why This Matters Beyond California

The outcome of this vote could influence wealth tax proposals across the U.S. If California—home to the highest concentration of billionaires in the country—rejects the measure, it may discourage similar efforts elsewhere.

On the other hand, if the tax passes, it could set a national precedent for taxing extreme wealth, reshaping how states fund public programs and regulate high-net-worth individuals.

Final Thoughts

Peter Thiel’s $3 million donation isn’t just a financial gesture—it’s a political signal. As California debates whether to tax its richest residents, the battle lines are forming between economic growth, wealth redistribution, and the future of innovation.

With billions of dollars, political influence, and the state’s reputation at stake, the California billionaire wealth tax fight is only just beginning.