JPMorgan Chase & Co. — the largest bank in the United States — has announced a landmark investment of up to $10 billion in U.S. companies that play a crucial role in national security and economic resilience.

The initiative, unveiled on Monday, is part of JPMorgan’s Security and Resiliency Initiative, a 10-year, $1.5 trillion strategy aimed at strengthening America’s critical industries, boosting supply chain independence, and accelerating investment in strategic technologies that safeguard the nation’s future.

Four Key Investment Pillars: Strengthening the U.S. National Security Backbone

According to the announcement, JPMorgan’s $10 billion direct investment will focus on four high-priority sectors:

Critical Supply Chains & Advanced Manufacturing

Investments will target critical minerals, pharmaceutical precursors, and industrial robotics — all essential components for U.S. economic and defense infrastructure.Defense & Aerospace

Funding will support companies driving innovation in military technology, advanced defense systems, and aerospace manufacturing to maintain America’s strategic edge.Energy Independence & Grid Resilience

JPMorgan plans to back battery storage, energy infrastructure, and grid modernization projects to enhance U.S. energy security and reduce dependence on foreign sources.Strategic Technologies

The bank will invest in cutting-edge areas like artificial intelligence (AI), cybersecurity, and quantum computing, ensuring the U.S. remains competitive in the global technology race.

This targeted investment aims to fortify America’s economic and security infrastructure, ensuring that essential technologies and resources remain under reliable domestic control.

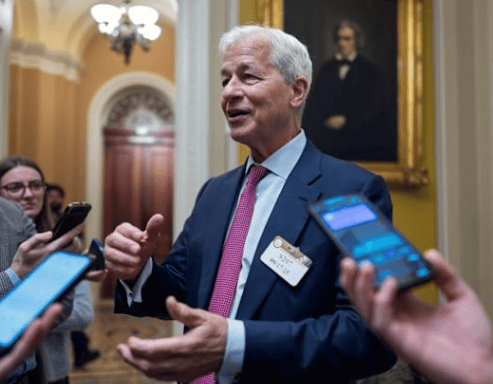

Jamie Dimon: “America Needs More Speed and Investment”

In a statement accompanying the announcement, Jamie Dimon, Chairman and CEO of JPMorgan Chase, emphasized the urgency of reducing reliance on vulnerable foreign supply chains.

“It has become painfully clear that the United States has allowed itself to become too reliant on unreliable sources of critical minerals, products and manufacturing — all of which are essential for our national security,” Dimon said.

“Our security is predicated on the strength and resiliency of America’s economy. America needs more speed and investment.”

Dimon also called for regulatory modernization and education system reform, arguing that bureaucratic delays and outdated skills training threaten to slow America’s ability to respond to global security and economic challenges.

A Growing Commitment: $1.5 Trillion Over 10 Years

The $10 billion investment is just one part of JPMorgan’s broader $1.5 trillion financing plan over the next decade. This strategy is designed to facilitate, finance, and invest in industries vital to U.S. security and resilience.

The bank is already playing a key role in strategic partnerships. Earlier this year, JPMorgan helped broker a $400 million investment from the U.S. Department of Defense into MP Materials, a leading American rare earth company. JPMorgan is also providing financing for MP Materials’ second U.S.-based magnet production facility — a critical step in rebuilding the domestic rare earth supply chain.

To further expand its impact, JPMorgan plans to increase financing capacity by up to 50% — from $1 trillion to $1.5 trillion — in strategic sectors. This represents one of the largest private sector investments in U.S. national security-related industries in recent history.

Supporting 34,000 Companies and 90% of the Fortune 500

JPMorgan Chase already serves more than 34,000 mid-sized businesses and works with over 90% of Fortune 500 companies. This vast network positions the bank to accelerate innovation and resilience across industries.

To execute its national security investment strategy, JPMorgan plans to:

Hire more bankers, investment professionals, and technical experts in defense, energy, and technology.

Establish an external advisory council featuring leaders from the public and private sectors to shape long-term strategy.

Collaborate with federal and state agencies to align investment with national priorities.

Why This Matters: National Security and Economic Resilience

This announcement reflects a growing trend of private sector alignment with national security objectives. As geopolitical tensions rise and global supply chains face disruption, major U.S. companies are stepping up efforts to onshore critical industries and fortify economic defenses.

For sectors like renewable energy, defense technology, AI, and advanced manufacturing, JPMorgan’s investment could unlock new capital flows, spur job creation, and accelerate domestic innovation.

“This is about ensuring that America leads in the industries that matter most — not just economically, but strategically,” said Dimon.

Key Takeaways

JPMorgan Chase to invest up to $10 billion in U.S. companies tied to national security and economic resilience.

Focus areas: defense & aerospace, energy independence, critical minerals, AI, cybersecurity, and quantum computing.

Part of JPMorgan’s broader $1.5 trillion Security and Resiliency Initiative over the next decade.

Goal: Reduce U.S. reliance on foreign supply chains and strengthen domestic manufacturing and technology.

CEO Jamie Dimon calls for “more speed and investment” and fewer regulatory barriers to growth.

JPMorgan plans to hire more experts and create a public-private advisory council to guide its national security investments.

The move reinforces America’s leadership in strategic industries and supports long-term economic stability.