California’s controversial wealth tax proposal is already reshaping the state’s financial future—and not in the way lawmakers intended. According to prominent venture capitalist Chamath Palihapitiya, the Golden State has lost an estimated $1 trillion in billionaire wealth in just weeks, as high-net-worth residents move their money, businesses, and families elsewhere.

The proposed tax, which would impose a one-time 5% levy on assets exceeding $1 billion, is still under consideration for the November ballot. Yet its economic impact is already being felt across Silicon Valley, real estate markets, and state tax revenues.

A Billionaire Exodus from California

California has long relied on its billionaire class to help fund public services. From income taxes to property taxes, luxury spending to job creation, the state’s wealthiest residents have historically contributed a significant share of revenue.

But Palihapitiya warns that the tide is turning fast.

“We had $2 trillion of billionaire wealth just a few weeks ago. Now, 50% of that wealth has left,” he wrote on X.

“They took their income tax revenue, sales tax revenue, real estate tax revenue, and their entire staffs with them.”

This capital flight from California isn’t just about money—it’s about people, jobs, and long-term economic stability. When billionaires relocate, their companies often follow, along with thousands of employees and millions in local spending.

Why the Wealth Tax Is Sparking Controversy

The proposed ballot initiative, backed by the Service Employees International Union–United Healthcare Workers West, aims to raise revenue for healthcare programs by taxing ultra-wealthy residents.

Supporters argue the measure could help offset federal funding cuts and reduce wealth inequality.

Critics, however, say the policy risks doing the opposite—shrinking the tax base and forcing the middle class to shoulder more of the financial burden.

“California billionaires were reliable taxpayers,” Palihapitiya said.

“They were the sheep you could shear forever. Now California will lose this revenue source forever.”

His warning highlights a key concern: once wealth leaves the state, it may never return.

Google Co-Founder and Tech Leaders Look Elsewhere

The trend isn’t limited to anonymous investors. High-profile figures, including Google co-founder Sergey Brin, are reportedly moving businesses and assets out of California ahead of the proposed billionaire tax.

Silicon Valley, once the undisputed global tech capital, is facing growing competition from Texas, Florida, and other low-tax states. These regions offer:

Lower income taxes

Business-friendly regulations

Affordable real estate

Fewer wealth taxes

For entrepreneurs and investors, the math is simple: keep more of what you earn.

The Middle Class Could Pay the Price

Perhaps the most alarming consequence of the billionaire flight is its impact on everyday Californians.

When the wealthiest residents leave, the state still needs funding for:

Public schools

Healthcare systems

Infrastructure

Emergency services

Housing programs

If billionaire tax revenue disappears, middle-income families may face:

Higher income taxes

Increased sales taxes

Rising property taxes

Reduced public services

As Palihapitiya bluntly put it:

“With no rich people left in California, the middle class will have to foot the bill.”

This raises serious questions about whether the proposed tax truly helps working families—or ultimately hurts them.

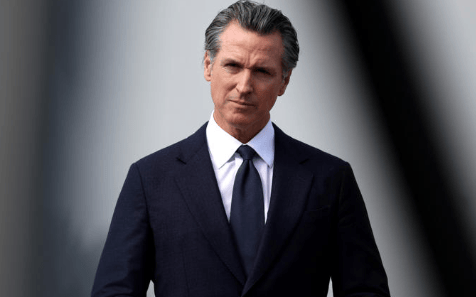

Governor Newsom’s Cautious Stance

California Governor Gavin Newsom has publicly opposed the billionaire wealth tax, while urging voters not to panic.

Speaking at The New York Times DealBook conference, Newsom said the proposal reflects broader concerns about wealth inequality but warned against unintended consequences.

“It’s part of the narrative of the haves and have-nots,” he said, “not just income inequality, but wealth inequality.”

Still, his remarks suggest the state is walking a political tightrope—balancing social justice goals with economic reality.

What Happens Next?

If the initiative moves forward and passes in November, California could see:

Accelerated billionaire migration

Reduced state tax revenue

Business relocations

Job losses

Increased pressure on middle-class taxpayers

On the other hand, pulling the measure could slow the wealth exodus and stabilize the state’s financial outlook.

Either way, the debate over the California billionaire tax is shaping up to be one of the most significant economic battles in the state’s recent history.

Final Thoughts: A High-Stakes Economic Gamble

California’s wealth tax proposal was designed to fund healthcare and address inequality. But early signs suggest it may be triggering the opposite effect—driving away the very people who fund the system.

With $1 trillion already gone, the Golden State faces a crucial decision: double down on taxing the ultra-wealthy or rethink its approach to protecting long-term economic growth.

One thing is clear—when billionaires leave, the consequences don’t stay at the top. They ripple through every community, every household, and every paycheck.